Investing in stocks and mutual funds can be a great way to grow your wealth over time. However, it’s important to understand how qualified dividends and capital gain tax worksheet come into play when it comes to taxes. These types of investment income are taxed at lower rates than ordinary income, making them a popular choice for investors.

Qualified dividends are dividends paid by a U.S. corporation or a qualified foreign corporation that meet certain criteria set by the IRS. These dividends are taxed at capital gains rates, which are typically lower than ordinary income tax rates. This can result in significant tax savings for investors.

qualified dividends and capital gain tax worksheet

Understanding the Qualified Dividends and Capital Gain Tax Worksheet

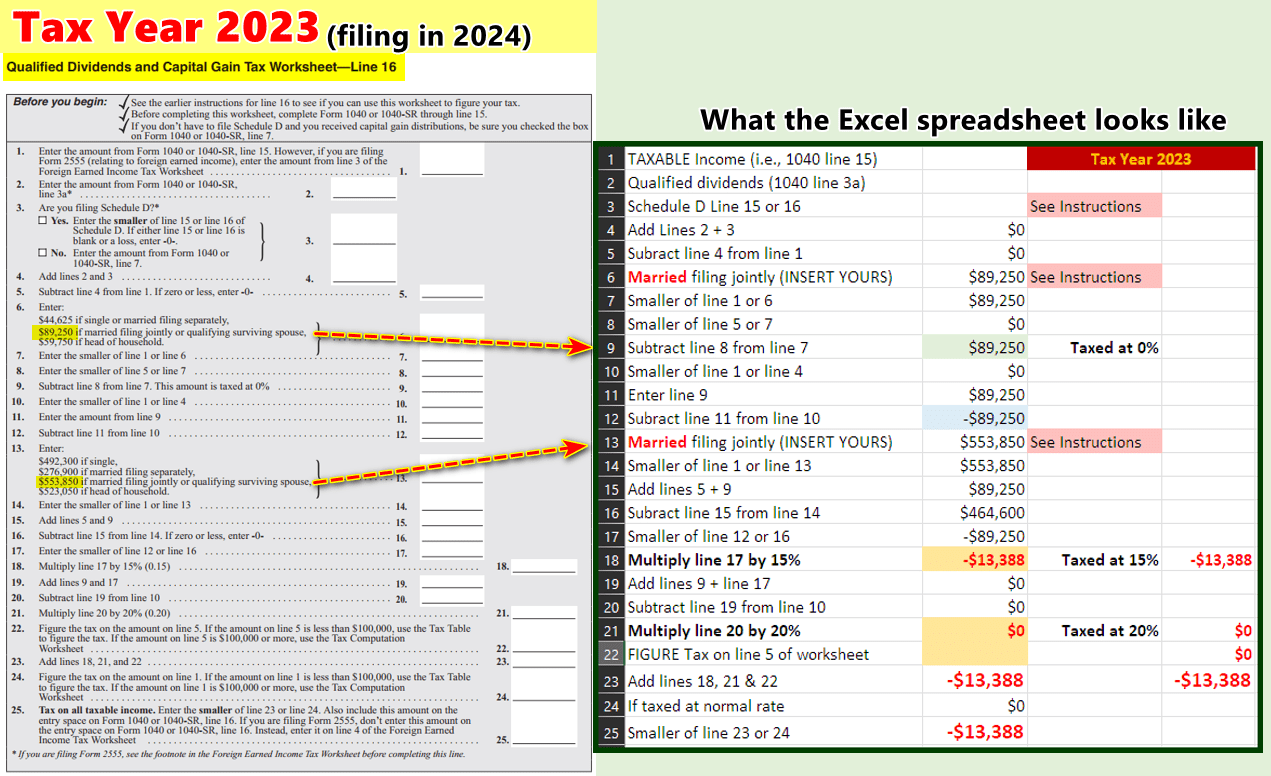

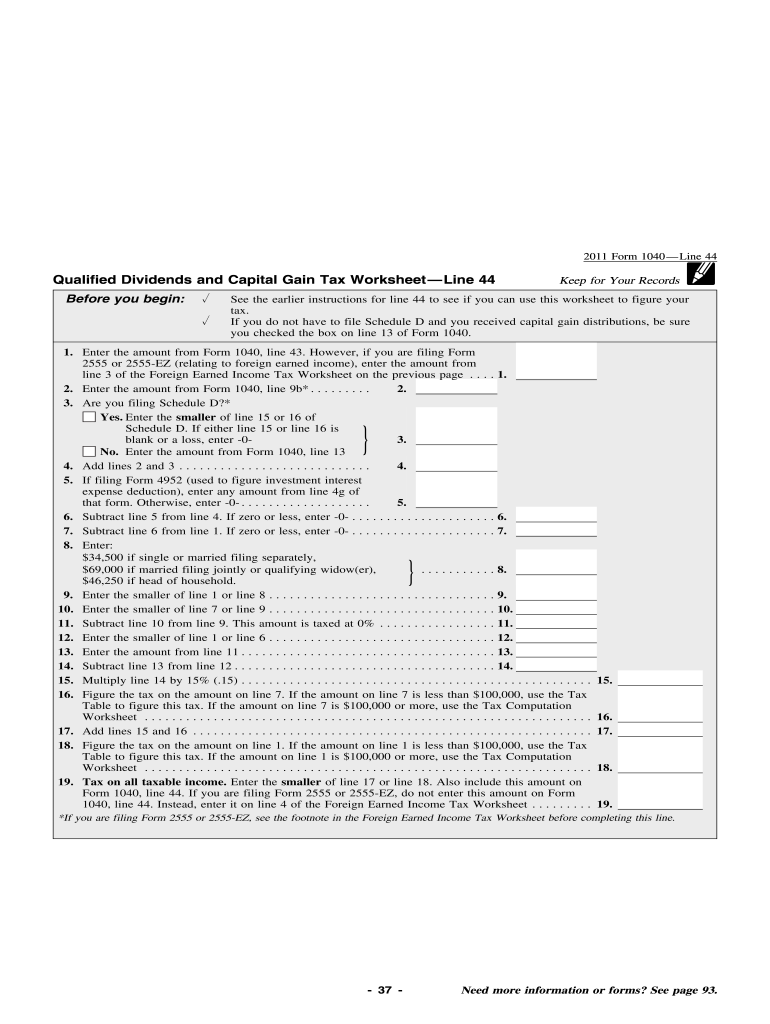

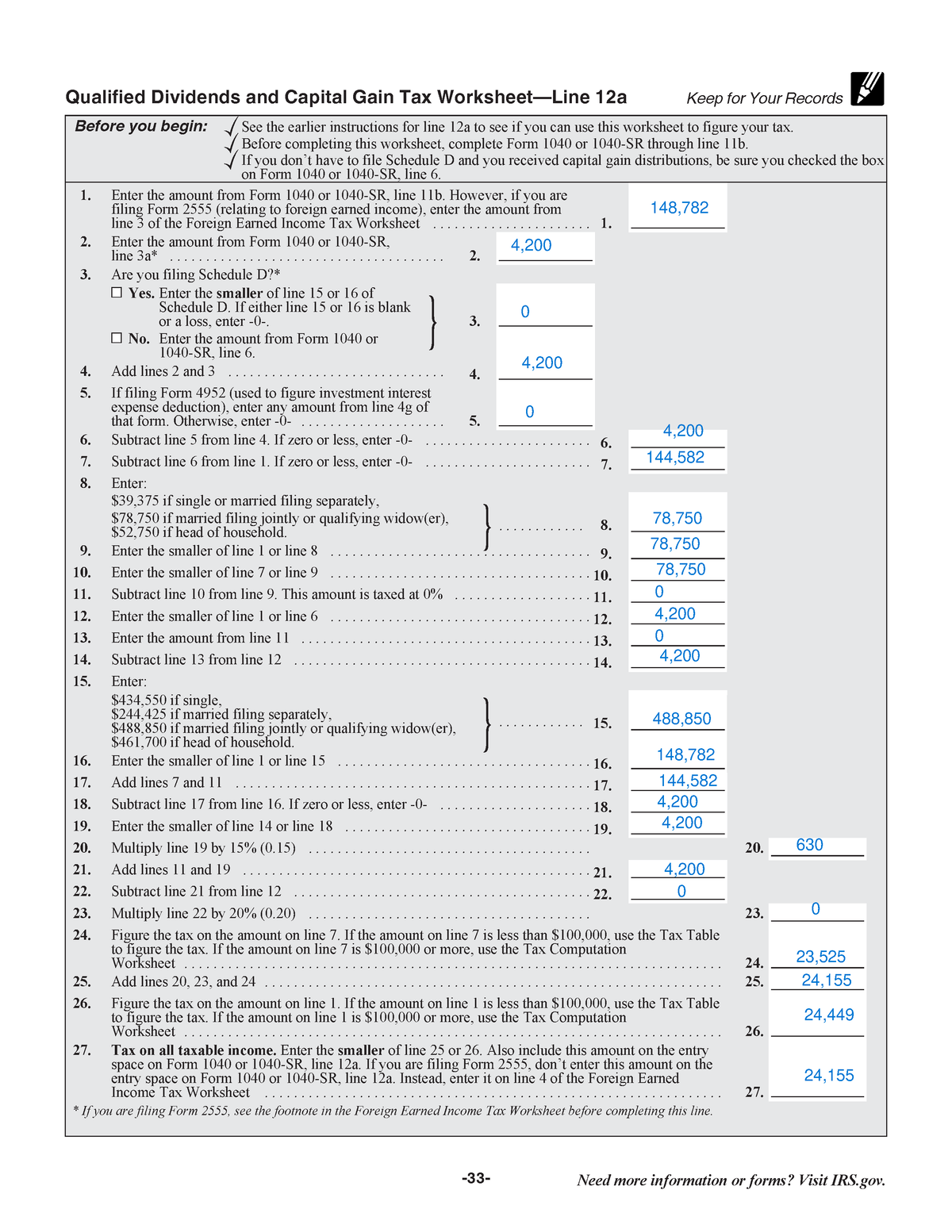

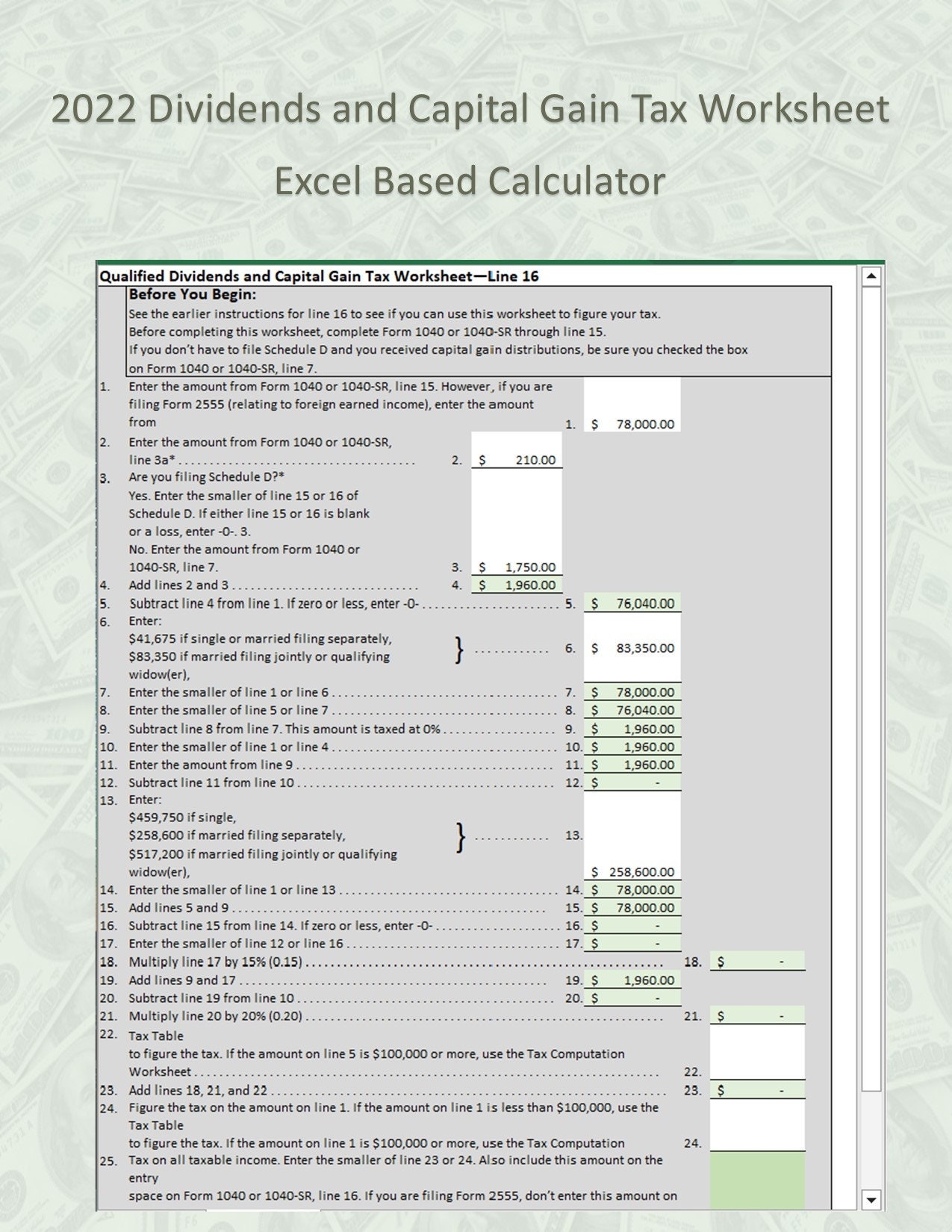

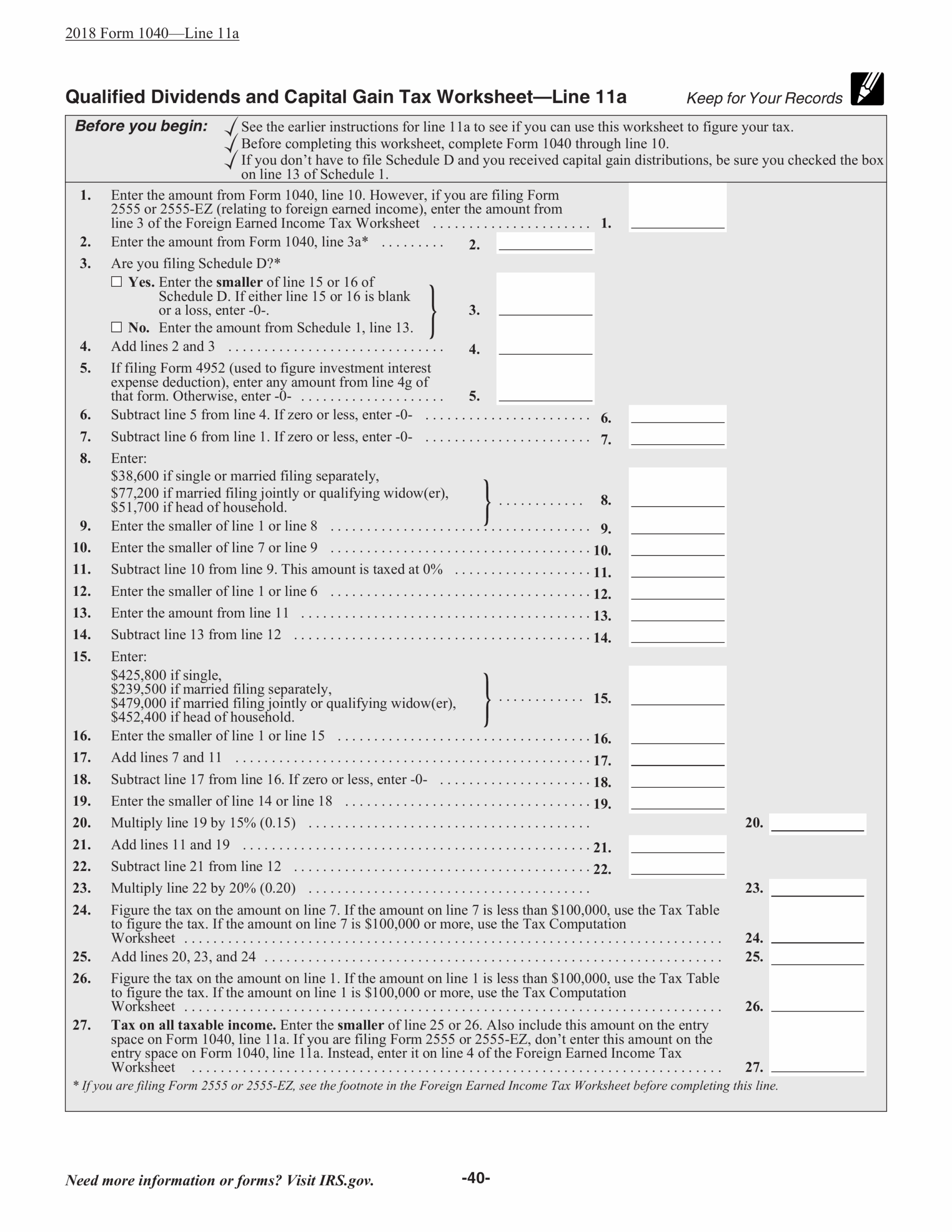

When it comes to calculating the tax owed on your qualified dividends and capital gains, you’ll need to fill out the Qualified Dividends and Capital Gain Tax Worksheet. This form helps you determine the tax rate you’ll pay on these types of investment income based on your total taxable income.

The worksheet takes into account factors such as filing status, total income, and deductions to calculate the tax rate that applies to your qualified dividends and capital gains. By using this worksheet, you can ensure that you’re paying the correct amount of tax on your investment income.

It’s important to note that not all dividends qualify for the lower tax rates. Non-qualified dividends, such as those paid by real estate investment trusts (REITs) or certain foreign corporations, are taxed at ordinary income tax rates. Be sure to differentiate between qualified and non-qualified dividends when reporting your investment income on your tax return.

In conclusion, understanding how qualified dividends and capital gain tax worksheet work is essential for investors looking to maximize their tax savings. By utilizing the worksheet and knowing the difference between qualified and non-qualified dividends, you can make informed decisions when it comes to your investment portfolio and tax planning.

Qualified Dividends And Capital Gain Tax Worksheet A Basic Worksheets Library

Qualified Dividends And Capital Gains Worksheet 2023 Fill Out Worksheets Library

Qualified Dividends And Capital Gains Worksheet Page 33 Of 108 Worksheets Library

Easy Calculator For 2022 Qualified Dividends And Capital Gain Tax Worksheet excel 2016 Also Includes Tax Computation Worksheet Etsy

Fill Out Your Capital Gains Worksheet PDF Guru