Thinking about taxes can be overwhelming, but understanding the basics can help ease the stress. One important aspect to consider is the qualified dividend and capital gain worksheet.

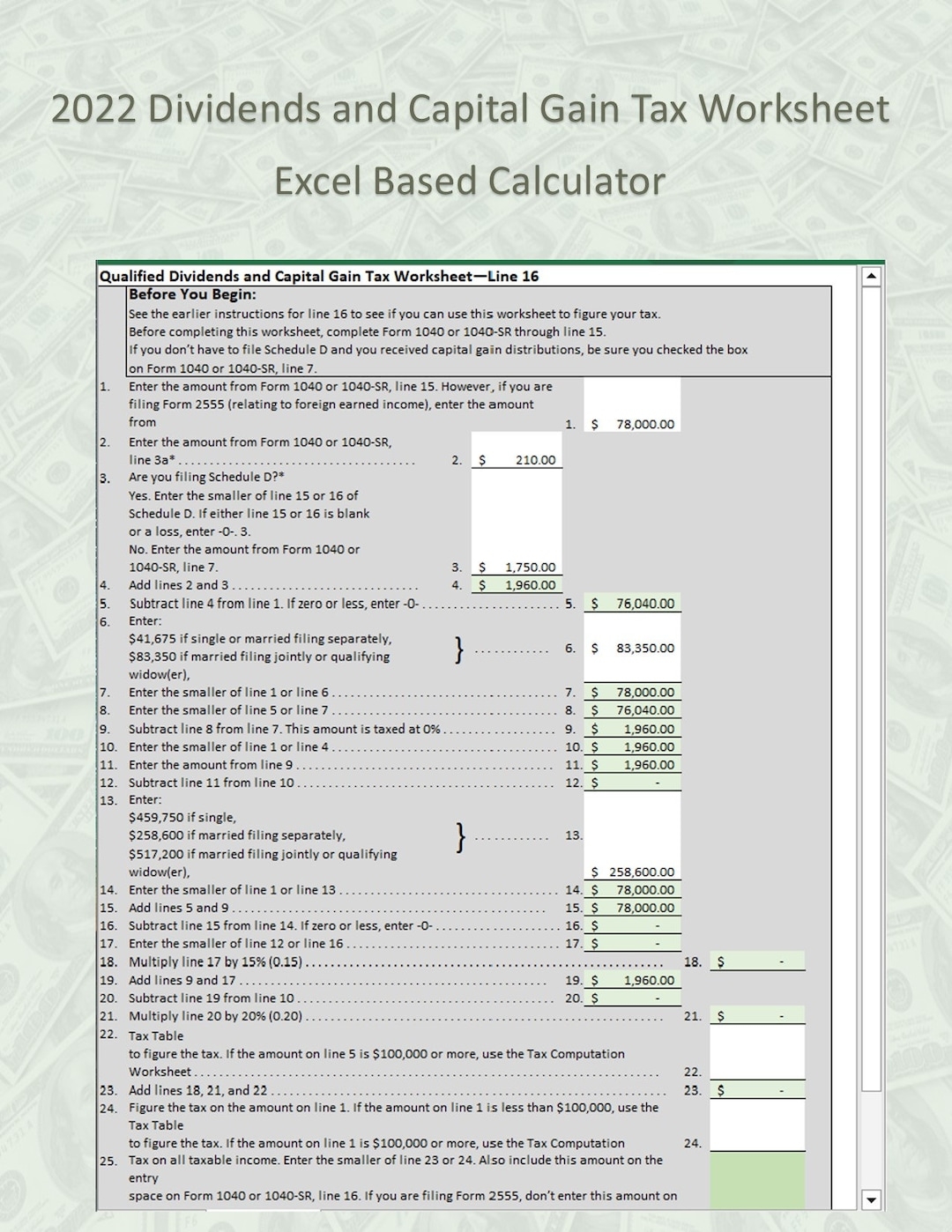

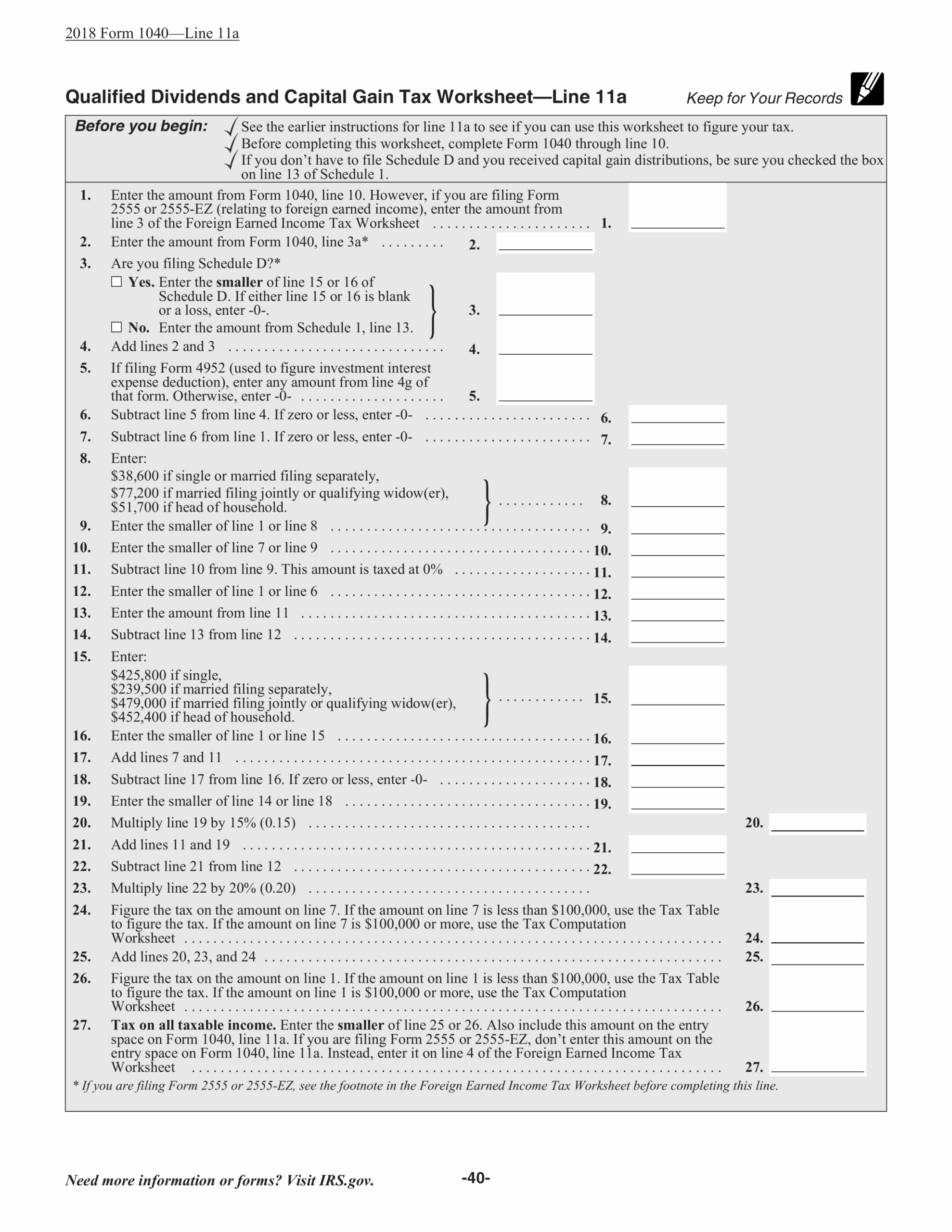

When it comes to investing, knowing how to calculate your qualified dividends and capital gains is crucial for tax purposes. This worksheet helps you determine the tax rate you’ll pay on these types of income.

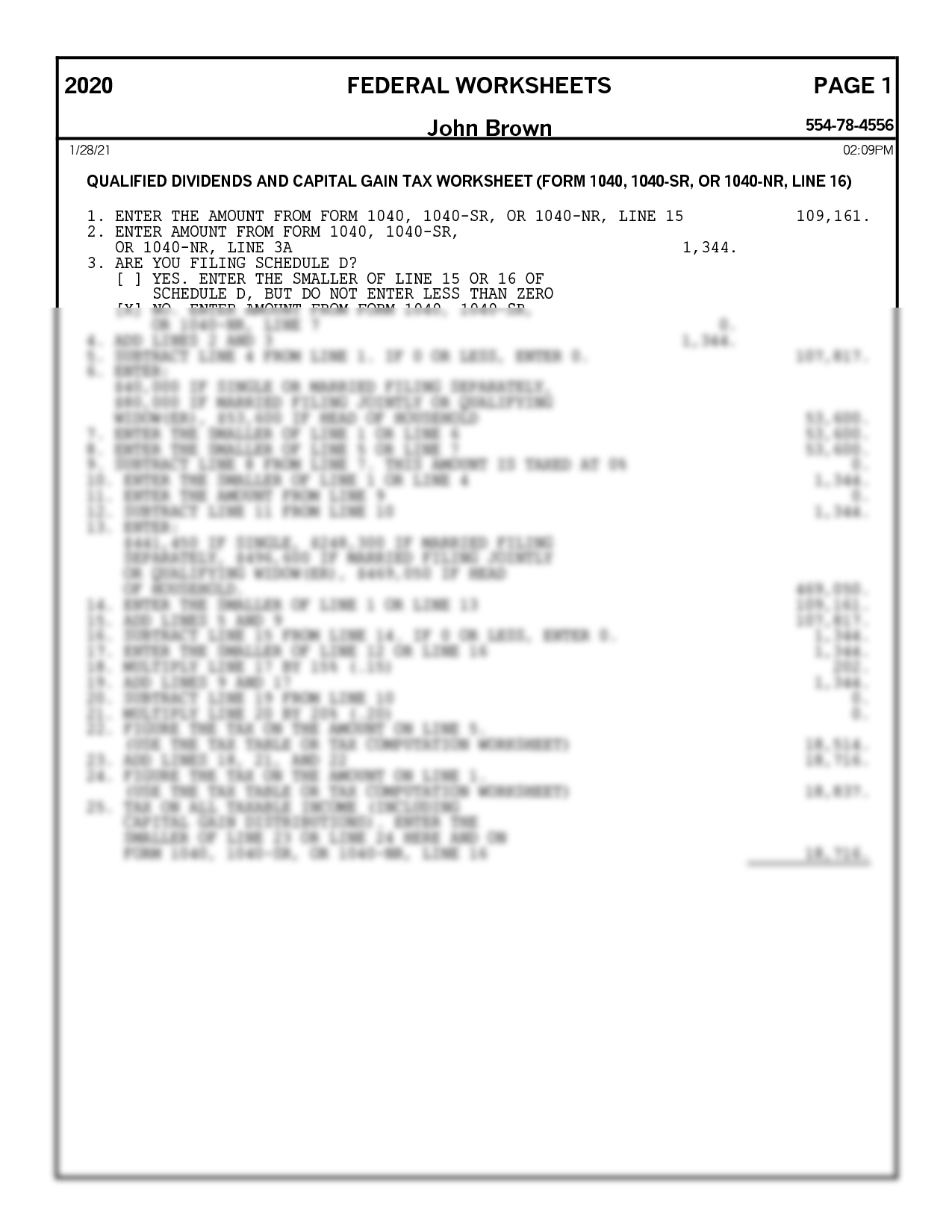

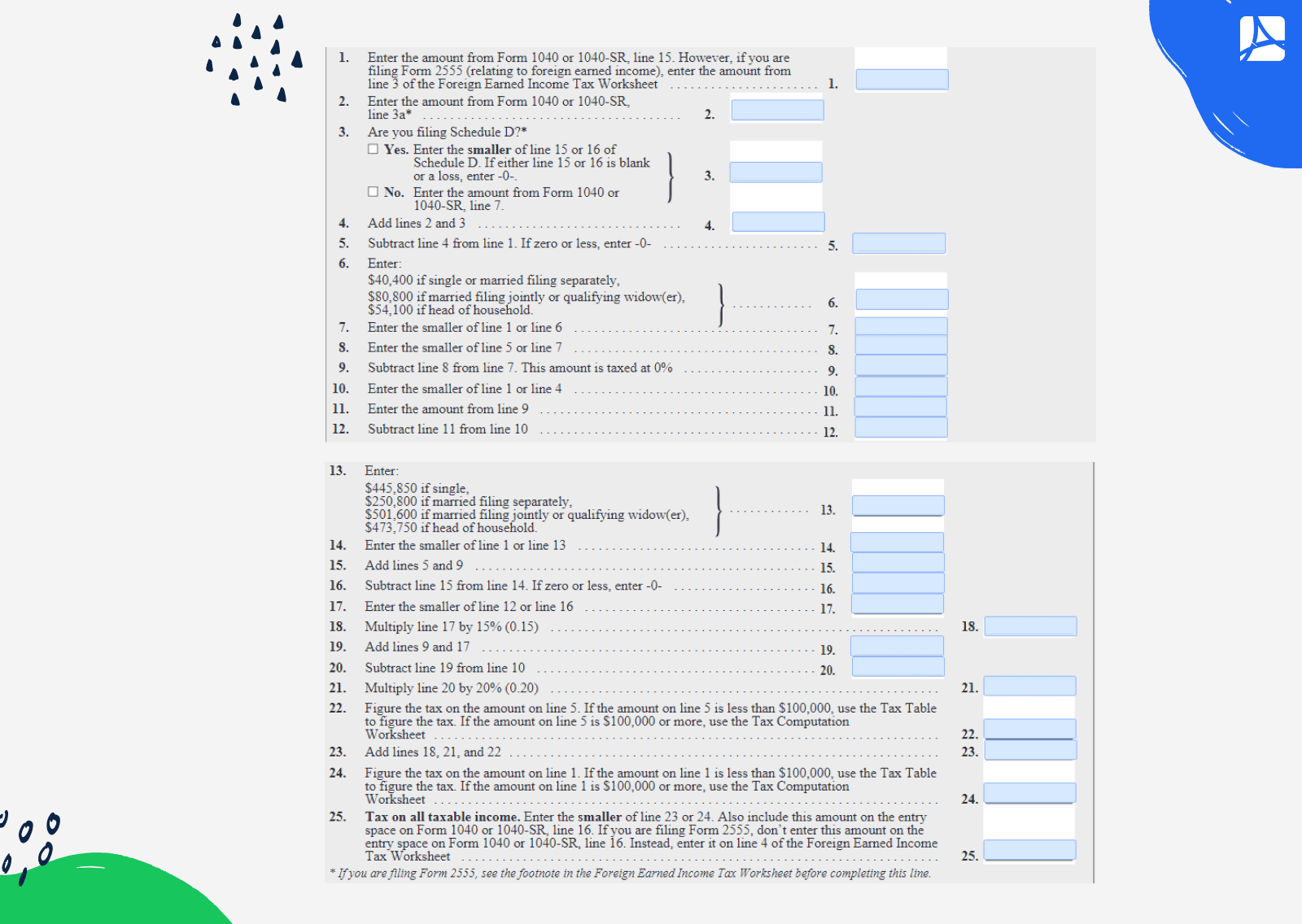

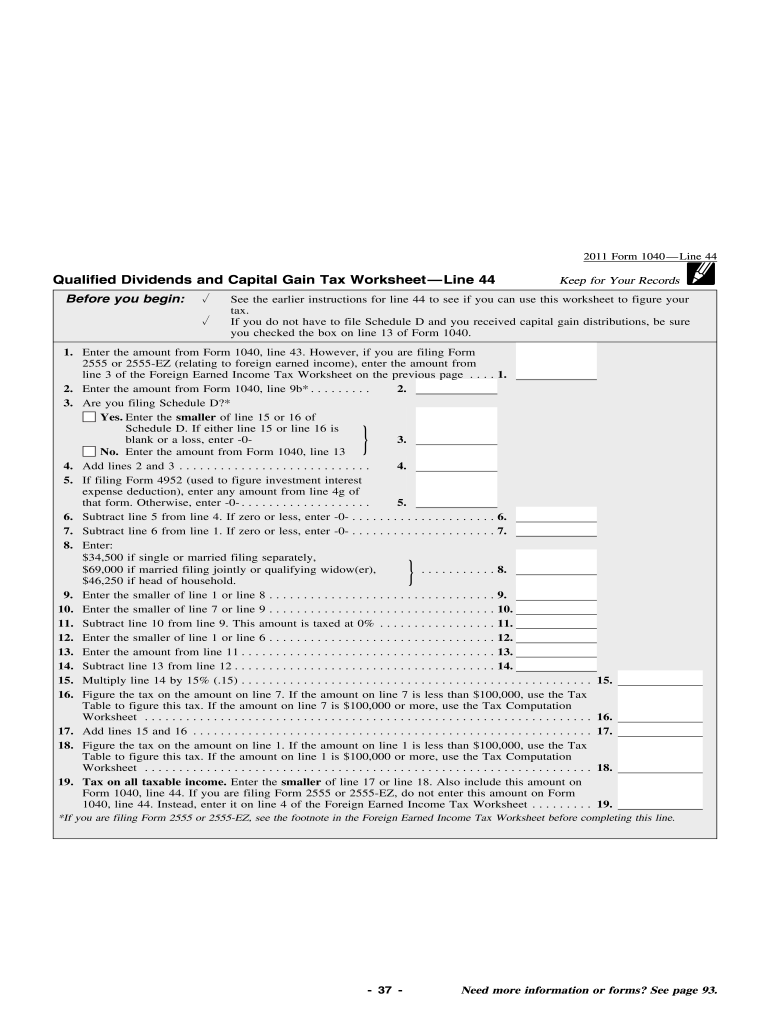

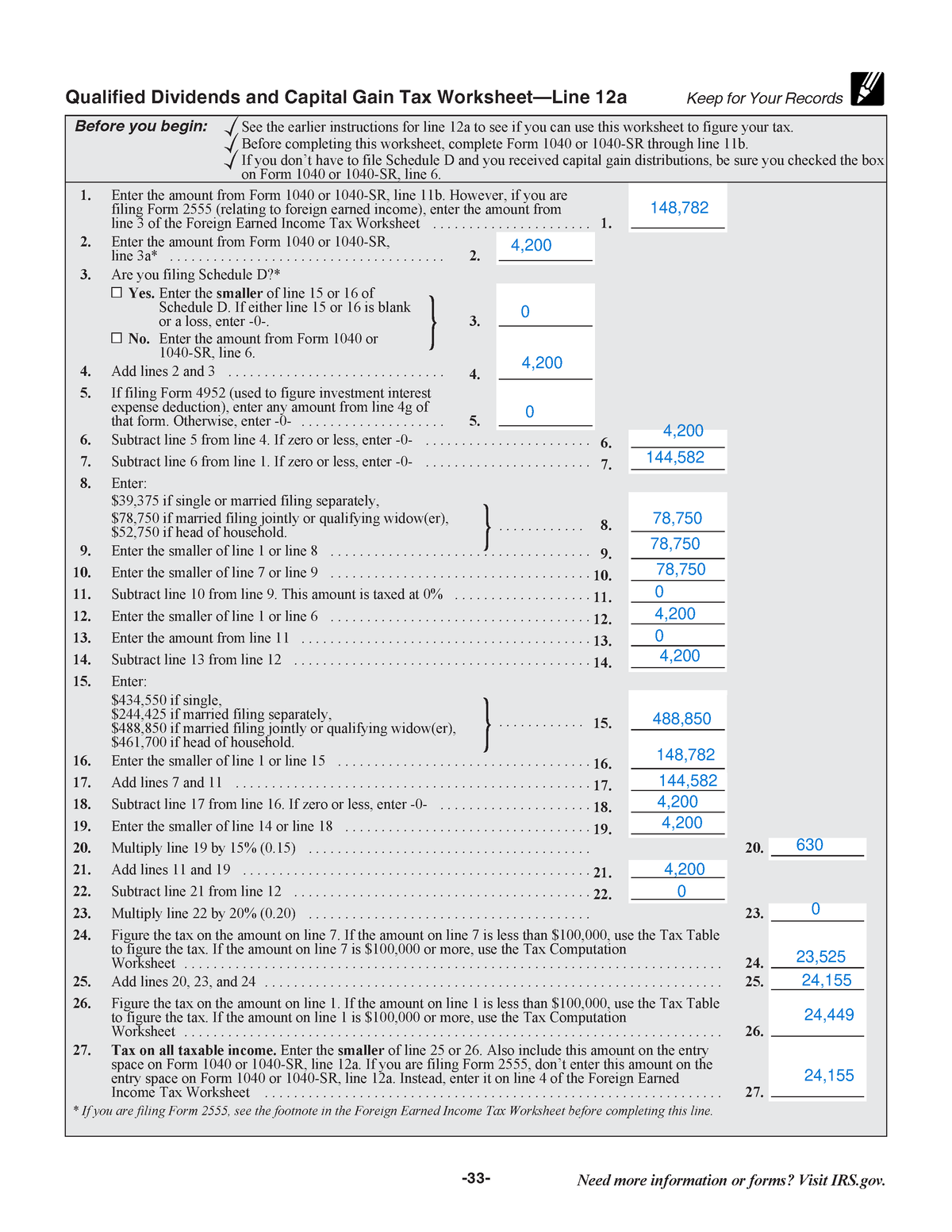

qualified dividend and capital gain worksheet

What is the Qualified Dividend and Capital Gain Worksheet?

The qualified dividend and capital gain worksheet is a tool used to calculate the tax rate on qualified dividends and long-term capital gains. These rates are typically lower than ordinary income tax rates, making them advantageous for investors.

To use the worksheet, you’ll need to gather information on your income, deductions, and credits. By following the instructions provided, you can determine the tax rate that applies to your qualified dividends and capital gains.

It’s important to note that not all dividends and capital gains qualify for this lower tax rate. Understanding the criteria for qualification is essential to accurately complete the worksheet and avoid any potential tax issues.

In conclusion, the qualified dividend and capital gain worksheet is a valuable tool for investors looking to optimize their tax liabilities. By taking the time to understand how it works and applying it correctly, you can potentially save money on your taxes and maximize your investment returns.

Qualified Dividends And Capital Gain Tax Worksheet 2023 PDFliner Worksheets Library

Qualified Dividends And Capital Gains Worksheet 2023 Fill Out Worksheets Library

Qualified Dividends And Capital Gains Worksheet Page 33 Of 108 Worksheets Library

Easy Calculator For 2022 Qualified Dividends And Capital Gain Tax Worksheet excel 2016 Also Includes Tax Computation Worksheet Etsy

Fill Out Your Capital Gains Worksheet PDF Guru