Are you looking to understand more about qualified dividends and the capital tax worksheet? Don’t worry, we’ve got you covered. It’s essential to grasp the basics of these concepts to navigate your finances effectively.

Qualified dividends are dividends that meet specific criteria set by the IRS. They are typically taxed at lower rates than ordinary dividends, making them a popular choice for investors. Understanding how they work can help you make informed investment decisions.

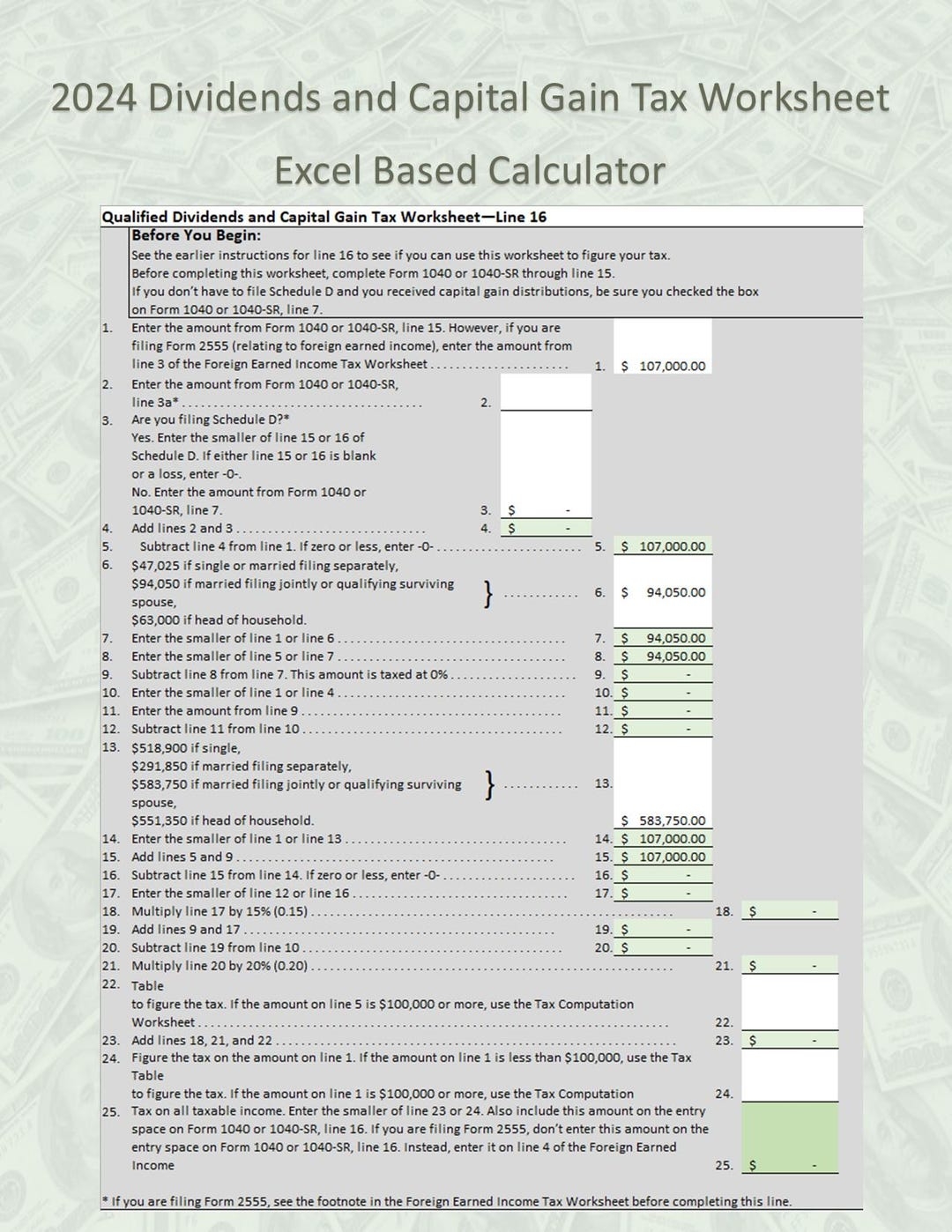

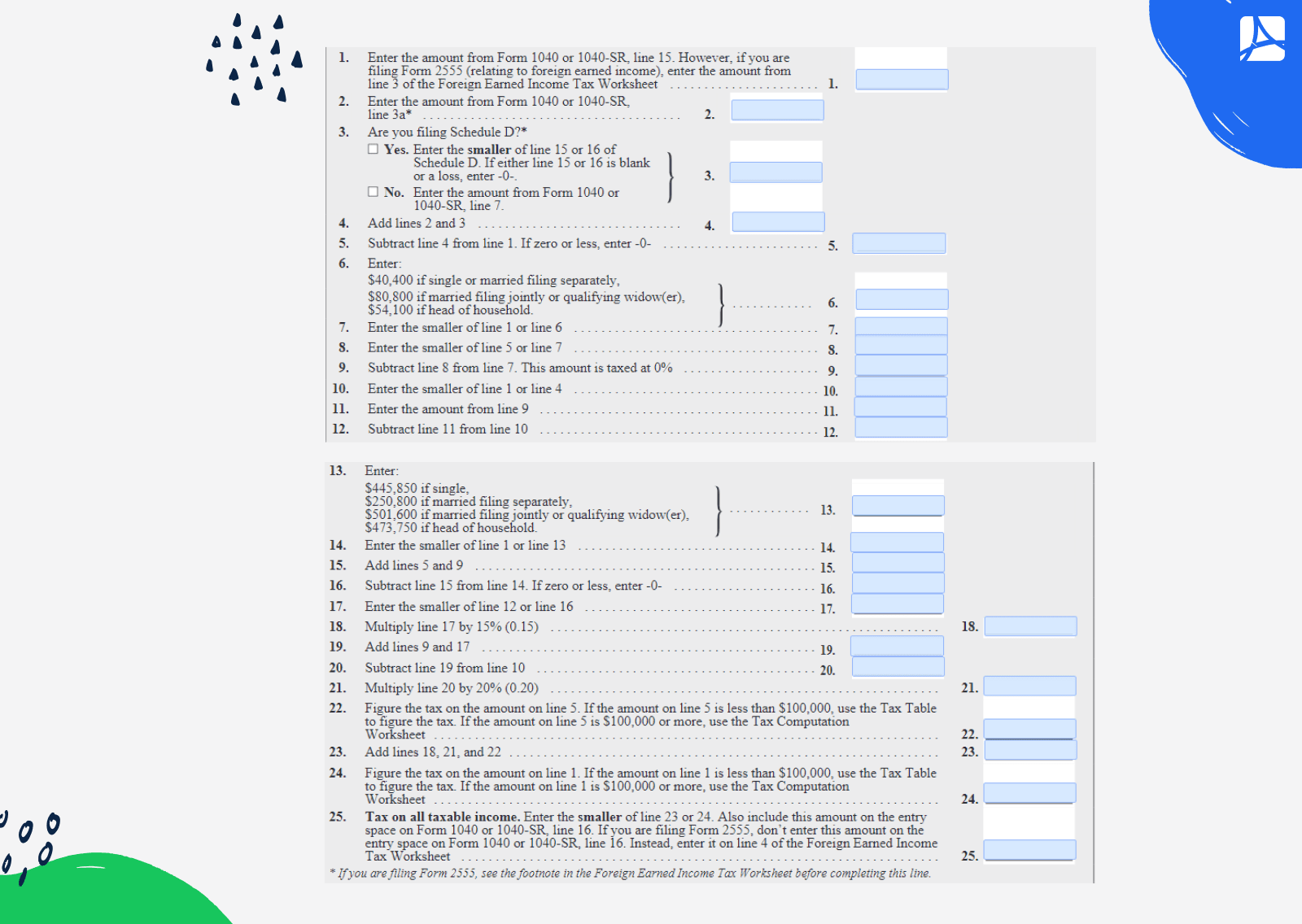

qualified dividends and capital tax worksheet

Exploring the Capital Tax Worksheet for Qualified Dividends

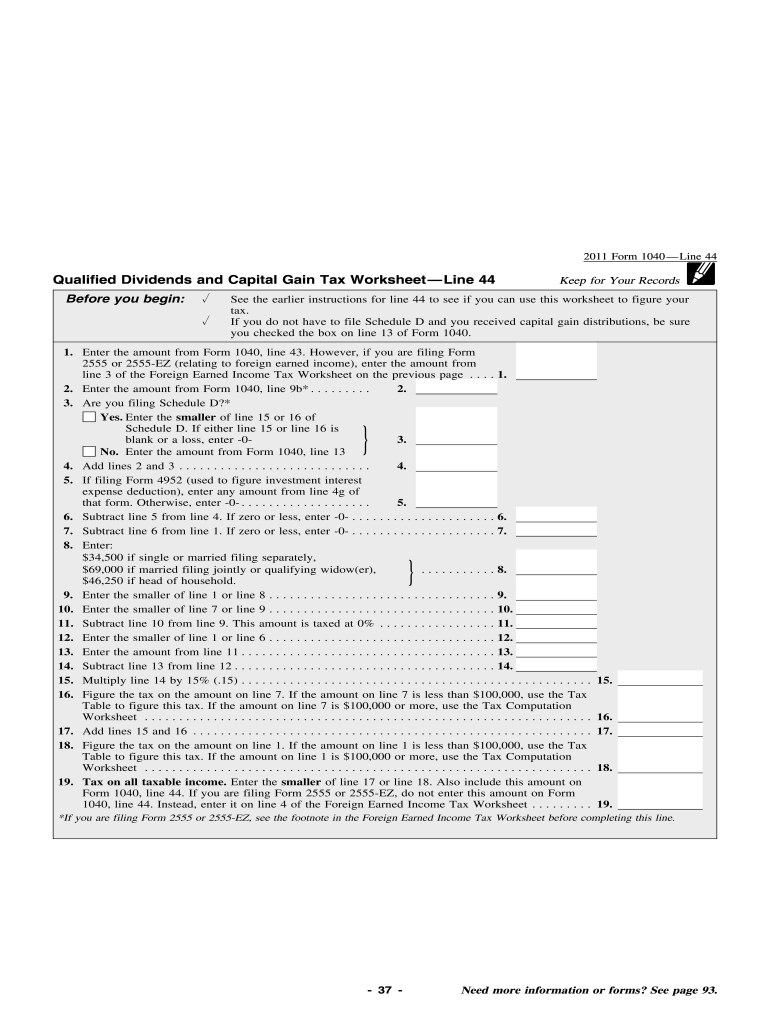

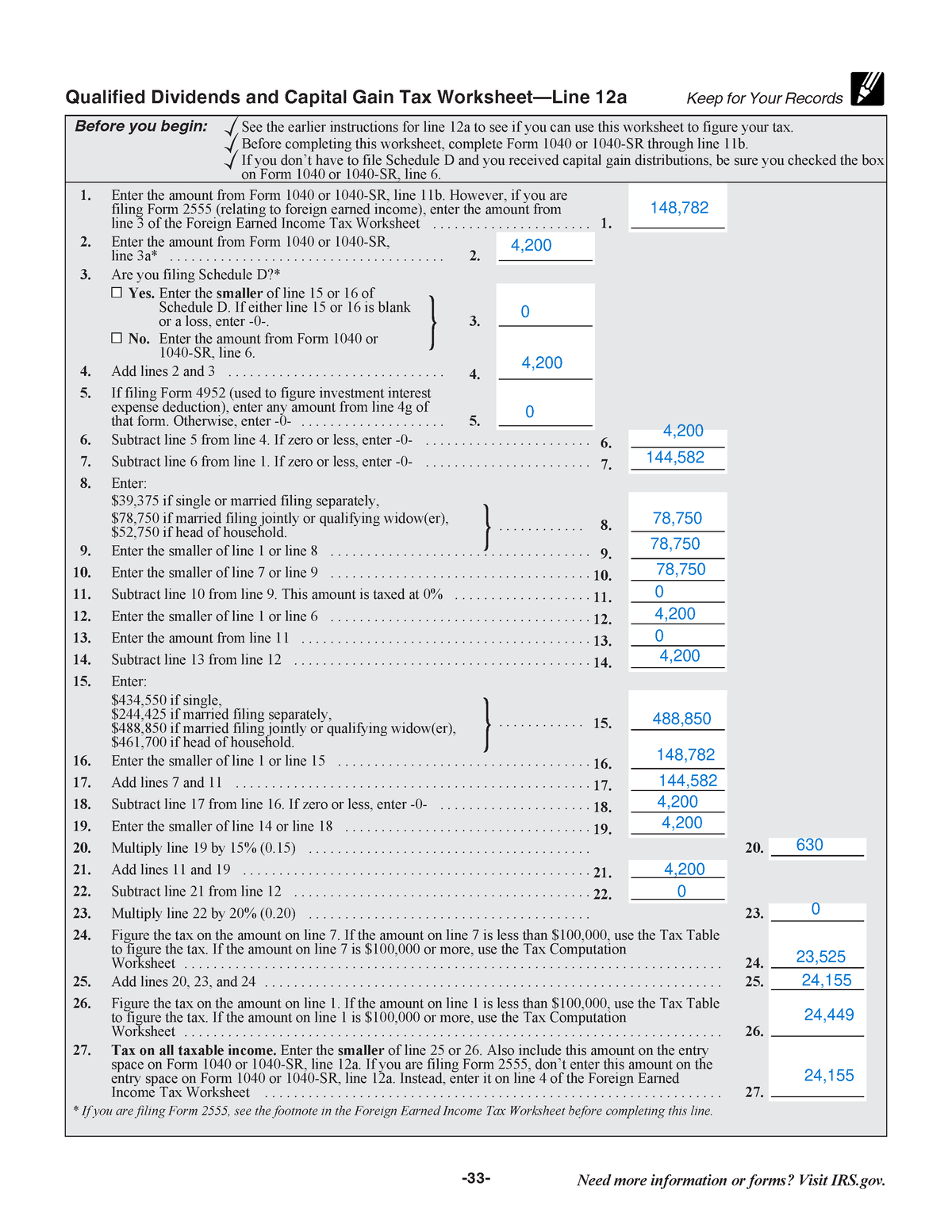

When it comes to calculating your taxes on qualified dividends, the capital tax worksheet comes into play. This worksheet helps you determine the tax rate applicable to your dividends based on your income level. It’s crucial to fill it out accurately to avoid any discrepancies.

By utilizing the capital tax worksheet, you can ensure that you’re paying the correct amount of tax on your qualified dividends. This can help you maximize your investment returns and avoid any potential penalties for underpayment. Take the time to understand how this worksheet works to make the most of your investments.

In conclusion, grasping the ins and outs of qualified dividends and the capital tax worksheet is essential for any investor. By familiarizing yourself with these concepts, you can make informed financial decisions and optimize your tax liabilities. So, dive in, learn more, and take control of your financial future!

Solved Qualified Dividends And Capital Gain Tax Worksheet Missing

Qualified Dividends And Capital Gains Worksheet 2023 Fill Out Worksheets Library

Qualified Dividends And Capital Gains Worksheet Page 33 Of 108 Worksheets Library

Easy Custom Calculator For 2024 Qualified Dividends And Capital Gain Tax Worksheet excel 2016 Also Includes Tax Computation Worksheet Etsy

Qualified Dividends And Capital Gain Tax Worksheet 2024 PDFliner